The global poultry market is set to hit $375.41 billion by 2030, growing at 3.5% annually. In the U.S., the poultry industry is huge, with 15.9 billion fresh meat sales and 5.74 billion pounds of turkey. The chicken & turkey meat production in the U.S. was worth $59.1 billion in 2023, showing how much people love poultry.

Creating a solid financial plan, like a cash flow plan, is key to a broiler farm’s success. This article will show you how to make a detailed cash flow plan for your farm. It will help you understand the poultry market better and make smart choices to boost your farm’s earnings.

Key Takeaways

- The global poultry market is expected to reach $375.41 billion by 2030, presenting significant growth opportunities for broiler farms.

- The U.S. poultry industry recorded 15.9 billion fresh meat sales and 5.74 billion pounds of turkey production, highlighting the industry’s strength.

- Developing a comprehensive cash flow plan is crucial for the success of a broiler farm business, as it allows for better financial management and strategic decision-making.

- Understanding the startup costs, financing options, revenue streams, and operating expenses, aiskey eltoreating an effective cash flow plan for a broiler farm.

- Regularly monitoring, reviewing, and updating the cash flow plan is essential to adapt to changing market conditions and optimize the farm’s financial performance.

Introduction to Broiler Farm Financial Planning

Creating a solid cash flow plan is key for broiler farming. It helps farmers manage money, predict earnings, and keep costs low. This ensures a profitable and lasting poultry business.

Importance of a Cash Flow Plan for Broiler Farms

The poultry industry in the U.S. is booming, with chicken and turkey sales hitting $59.1 billion in 2023. The global poultry market is also growing fast, expected to hit $375.41 billion by 2030. Knowing these trends is vital for a broiler farm’s financial success.

Overview of the Poultry Industry and Market Trends

A good poultry farm financial planning strategy can help farmers grow with the industry. A detailed cash flow plan lets farmers manage money well, make smart choices, and outdo rivals in the fast-changing poultry market.

| Key Poultry Industry Statistics | Value |

|---|---|

| Average Eggs Laid per Layer Chicken per Year | 325 |

| Chicks Produced by 500 California White Birds in 40 Days | 12,000 |

| Time to Market Readiness for Poultry Birds | 27-28 weeks |

| Market Price Range for a Fully Grown Healthy Chicken | $10 – $11 |

| Monthly Income from Selling 12,000 Eggs from 500 Layers | $1,500 |

“Poultry business profitability can lead to doubling income within a year.”

Calculate Business Startup Costs

Figuring out the startup costs for a broiler farm is key to making a solid financial plan. Costs can vary a lot, from buying land or renting it to building houses for the chickens. You also need to think about buying equipment, getting chickens, hiring staff, and getting the right licenses.

Identifying Initial Expenses for Broiler Farm Setup

To accurately estimate your broiler farm’s startup costs, consider several important factors:

- Land acquisition or rental costs

- Construction of poultry houses and other infrastructure

- Equipment and machinery purchases (e.g., feeders, waterers, brooders)

- Procurement of poultry stock (chicks or hatchlings)

- Labor costs for farm management and operations

- Business licenses, permits, and regulatory compliance

- Marketing and promotional expenses

Researching Local Market Conditions and Industry Benchmarks

It’s also vital to research local market conditions and industry benchmarks. This ensures your broiler farm is competitive and set for success. You should:

- Analyze the demand for broiler products in your area

- Look at the pricing and production costs of other broiler farms in your region

- Check the availability and cost of resources like feed, labor, and utilities

- Find out about any regulatory or zoning rules that might affect your farm

| Startup Cost Category | Estimated Range |

|---|---|

| Land Acquisition or Rental | $3,500 – $5,000 per acre |

| Poultry House Construction | $20,000 – $50,000 per house |

| Equipment and Machinery | $10,000 – $25,000 |

| Poultry Stock (200 chicks) | $700 |

| Vaccination and Hatchery | $1,500 – $12,000 |

| Estimated Total Startup Costs | $50,000 – $60,000 |

By carefully thinking about these factors and doing thorough market research, you can get a realistic idea of your broiler farm’s startup costs. This helps ensure your farm is set for long-term success.

Determine Financing Requirements and Strategy

First, check your current money situation and how much you need to start your broiler farm. Getting the right money is key to covering the high costs of starting a broiler farm.

Evaluating Current Financial Position and Capital Needs

Start by looking at what money you already have. This includes savings, investments, or assets you can use. This will show you how much more money you need for the farm’s start-up costs.

Think about the costs of land, building poultry houses, buying equipment, and setting up the farm. Also, remember you’ll need money for day-to-day expenses while you’re starting up.

Exploring Funding Options and Developing a Financing Plan

- Traditional bank loans: Look into what local banks, credit unions, or other lenders offer. They might have good rates and terms for broiler farms.

- Small Business Administration (SBA) loans: The SBA has loans like the 7(a) and CDC/504 loans. They might be good for your farm.

- Private investors: Look for angel investors, venture capitalists, or others who might want to help your farm.

- Crowdfunding: Use online sites to get money from many people who support your farm.

- Partnerships: Think about working with other farmers or industry folks. This can help you use their resources and know-how.

Look closely at each funding option’s terms, rates, and how you’ll pay back the money. This will help you make a plan that fits your goals and how much risk you’re willing to take. By looking at different options, you can find the best way to get the money you need for your farm.

Understand Your Broiler Farm Business Model

As a broiler farmer, knowing the different business models is key. Your choice affects your finances, how much you can earn, and your profit. It’s important to pick the right model for your farm.

The breeder farm model is common. These farms produce fertile eggs for hatching. They are usually 16,000 to 22,000 square feet and can make $4.40 to $4.60 per square foot each year.

The broiler farm model focuses on raising chickens for meat. These farms can have 300 to 400 houses, each handling up to one million birds weekly. The chickens are raised for 32 to 70 days, and farmers get paid 3.5 to 4.75 cents per pound.

Some farms are dual-purpose, raising chickens for both meat and eggs. This model helps diversify income. Pullet farms, which raise young female chickens for eggs, are another option. They can be 42,000 to 72,000 square feet and make $3.15 to $3.35 per square foot annually.

Specialty poultry farms cater to specific markets, like organic or free-range chickens. These farms might charge more but face higher costs and marketing hurdles.

Understanding these models and their financial aspects helps you make better choices. You can create a financial plan that fits your goals and situation.

Identify Revenue Streams for Broiler Production

As a broiler farmer, it’s key to find different ways to make money. This helps you make more profit and stay in business for a long time. You can look into other ways to earn money besides just selling meat. Check out the broiler farming market for ideas.

Diversifying Income Sources within the Poultry Farming Market

Think about selling eggs, feathers, and manure,e too. You could also make money from processed chicken products like nuggets. Some people might pay more for special or organic chicken.

Forecasting Revenue Potential from Various Income Streams

Creating a solid financial plan means predicting how much money you’ll make from each source. Things like demand, prices, how much you produce, and when you produce all affect your forecast. By studying these factors, you can make a better financial plan. This helps you make smart choices and attract investors or lenders.

| Revenue Stream | Estimated Annual Revenue |

|---|---|

| Poultry Meat | $500,000 |

| Eggs | $50,000 |

| Feathers | $25,000 |

| Manure | $20,000 |

| Processed Poultry Products | $75,000 |

By spreading your income across different areas and planning well, you can make your farm more stable and profitable. This way, you can handle changes in the market and find new chances in the broiler farm income diversification world.

How to Develop a Cash Flow Plan for Your Broiler Farm

Creating a cash flow plan for your broiler farm is key to financial success. Start with a detailed market analysis to understand your local market. This helps you set prices that are both competitive and profitable for your poultry products.

Market Analysis and Assumption Development

Accurate assumptions are vital for a reliable cash flow plan. When analyzing the market, consider:

- Current broiler chicken prices in your area

- Costs like feed, labor, and processing

- Seasonal changes in demand

- What your competitors charge and how they promote

- New trends in what customers want

Pricing Strategy and Sales Forecasting

With a good grasp of the market, you can set prices that are both profitable and competitive. Forecasting sales based on past data, trends, and marketing efforts is essential for a solid cash flow plan.

Industry data shows a 1,000-bird farm can make $5,116 to $6,616 in net cash income. Running such a farm costs about $15,000 a year. By using these insights, you can make a detailed plan for your farm’s success.

“Cash flow management is emphasized as crucial for the success of broiler farms, as volatile market conditions and unfavorable weather can have severe implications on cash flow.”

Make Financial Projections and Statements

As a broiler farmer, it’s key to make accurate financial plans and reports. This helps attract investors and shows your farm’s health. You’ll need to create cash flow and income statements with detailed numbers.

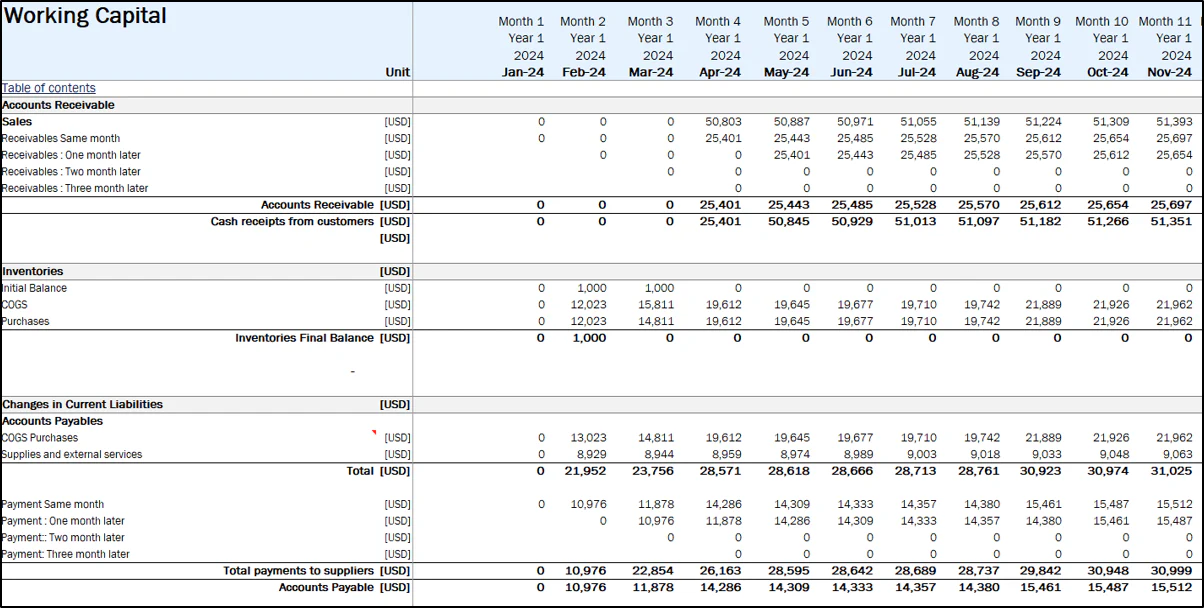

Preparing Cash Flow Statements and Income Statements

Cash flow statements show how money moves in and out of your farm. They track cash from sales, government help, and other sources. They also show money going out for expenses, interest, and investments. This helps spot cash flow problems and plan for the future.

Income statements measure your farm’s profit. They show total income, expenses, and net income. By watching these statements, you can spot trends and make better decisions for your farm.

Conducting Scenario Analysis and Stress Testing Assumptions

| Financial Projection | Baseline Scenario | Optimistic Scenario | Pessimistic Scenario |

|---|---|---|---|

| Broiler Production (lbs) | 2,000,000 | 2,200,000 | 1,800,000 |

| Broiler Price ($/lb) | $0.80 | $0.85 | $0.75 |

| Total Revenue | $1,600,000 | $1,870,000 | $1,350,000 |

| Total Expenses | $1,400,000 | $1,550,000 | $1,250,000 |

| Net Income | $200,000 | $320,000 | $100,000 |

Scenario analysis and stress testing are vital for your farm. They help spot risks and plan for different market conditions. This ensures your farm stays strong over time.

Monitor, Review, and Update Cash Flow Plan

It’s crucial to regularly monitor, review, and update your broiler farm’s cash flow plan. This helps you adjust to market changes and keep your business thriving. By comparing your actual performance to your financial plans, you can spot any issues. Then, you can adjust your assumptions and forecasts as needed.

This ongoing review and update cycle lets you make informed decisions. It keeps your broiler farm financially stable.

Tracking Actual Performance Against Projections

A cash flow statement helps you see cash inflows and outflows for your farm. It shows if you’ll have a deficit or surplus soon. Cash inflows include money from operating and capital activities, both on and off the farm.

Cash outflows cover farm expenses, family costs, loan payments, and debt repayment. This helps you manage your finances better.

Adjusting Assumptions and Revising Financial Forecasts

The accuracy of your cash flow statement depends on your revenue and expense predictions. It also relies on the detail and the time frame you choose (quarters, months, or weeks). The statement is set up with subperiods as columns and categories as rows.

This way, you can tailor the statement to fit your farm’s needs. It’s flexible for different planning periods and subperiods.

| Key Factors to Monitor and Adjust | Importance |

|---|---|

| Revenue Projections | Adjust based on actual sales, market trends, and changing customer demand. |

| Operating Expenses | Update to reflect actual costs of production, labor, utilities, and other variable expenses. |

| Capital Expenditures | Revise planned investments in equipment, facilities, and other infrastructure. |

| Financing Assumptions | Update interest rates, loan terms, and repayment schedules based on actual financing obtained. |

By keeping a close eye on your broiler farm’s cash flow, you can make informed changes. This ensures your cash flow plan stays useful for managing your business.

Cash Flow Management Strategies for Broiler Farms

Managing cash flow well is key for broiler farms to succeed. By finding ways to bring in more money and cut down on expenses, farms can make more profit. Let’s look at some important strategies for managing cash flow in broiler farms.

Increasing Cash Inflows from Operations and Non-Operational Sources

To increase cash, broiler farmers should work on making their operations more efficient. They can also try to get better prices for their products. This might mean improving how feed is used, lowering death rates, and finding new market opportunities.

Also, making money from non-farming activities like agritourism or adding value to products can help. This extra income can boost cash flow.

Reducing Cash Outflows and Optimizing Expenses

To improve cash flow, farmers should manage their spending carefully. They can try to get better deals from suppliers, outsource some tasks, and compare themselves to others in the industry. This helps find ways to save money.

By keeping a close eye on where money goes, farmers can make their finances stronger. This is crucial for their farm’s health.

| Cash Flow Management Strategies | Potential Benefits |

|---|---|

| Improving production efficiency | Reduced feed costs, lower mortality rates, and increased yields |

| Diversifying income streams | Additional revenue sources beyond broiler production |

| Negotiating better supplier contracts | Lower input costs and improved cash flow management |

| Benchmarking against industry standards | Identifying areas for cost optimization and increased profitability |

By using these strategies, broiler farmers can do better financially. They can also reduce risks and set their farms up for success in the competitive poultry market.

“Effective cash flow management is the lifeblood of any broiler farm, enabling producers to navigate market fluctuations, capitalize on opportunities, and secure their long-term viability.”

Creating a detailed broiler farm cash flow plan is key to your poultry farm’s success. It helps you manage your finances well. This includes knowing your startup costs, getting the right funding, and understanding your broiler farm business model.

It also means finding ways to make money, doing market research, making financial forecasts, and managing your cash flow. These steps help your broiler farm grow and become profitable.

Keep an eye on your cash flow plan and update it as needed. This lets you adjust to market changes and make smart choices. With good planning, your broiler farm can do well in the changing broiler farm financial planning world.

By using the strategies from this article, you can make a strong cash flow plan. It will help guide your financial decisions and help your broiler farm succeed in the long run.