The poultry industry in the United States makes over $70 billion each year. This makes it very appealing to investors. To grow your broiler chicken farm, you need a good…

Organic agricultural products right to your table!

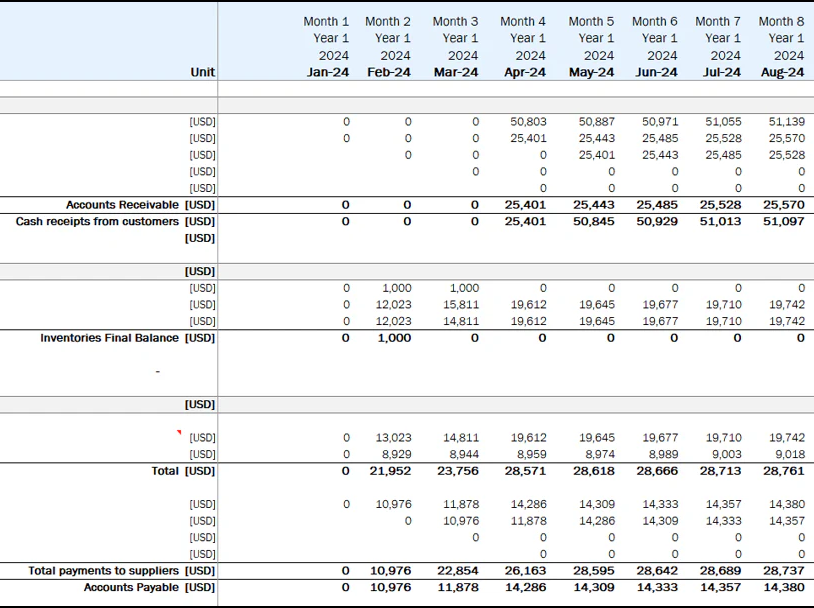

Investment in broiler farming requires a significant upfront capital commitment, with total funding often needing to cover both initial assets (CAPEX) and a “cash trough” buffer to sustain operations until the first harvest. In 2026, a mid-scale commercial operation typically requires between $150,000 and $500,000 for land, climate-controlled housing, and automated feeding systems. Financial planning must account for the fact that variable costs—primarily feed and livestock purchases—are the largest ongoing expenses, sometimes consuming up to 70–80% of total revenue. A robust plan should include a 3-to-9-month cash reserve to manage these high input costs and bridge the gap before the business reaches its break-even point.

Profitability in this sector is highly sensitive to the Feed Conversion Ratio (FCR) and mortality rates, making technological investment a strategic necessity rather than a luxury. Implementing AI-driven monitoring and automated ventilation can reduce labor costs by 50% and significantly improve bird health, directly impacting the bottom line. Investors should also focus on diversification and value-addition, such as processing meat on-site or utilizing waste for biogas, to create multiple revenue streams. By combining precise financial modeling with strict biosecurity protocols, farmers can achieve a rapid return on investment, often seeing positive cash flow within the first year of operation.

The poultry industry in the United States makes over $70 billion each year. This makes it very appealing to investors. To grow your broiler chicken farm, you need a good…

The global poultry market is set to hit $375.41 billion by 2030, growing at 3.5% annually. In the U.S., the poultry industry is huge, with 15.9 billion fresh meat sales…

Poultry and eggs are key in the American diet. Farmers in the poultry industry are vital to our economy and lifestyle. Americans eat 288 eggs per person and 8 billion…

The U.S. broiler production industry is unique. Almost all broilers are raised by farms under contract with poultry integrators. These growers provide the capital, utilities, and labor. Meanwhile, integrators give…

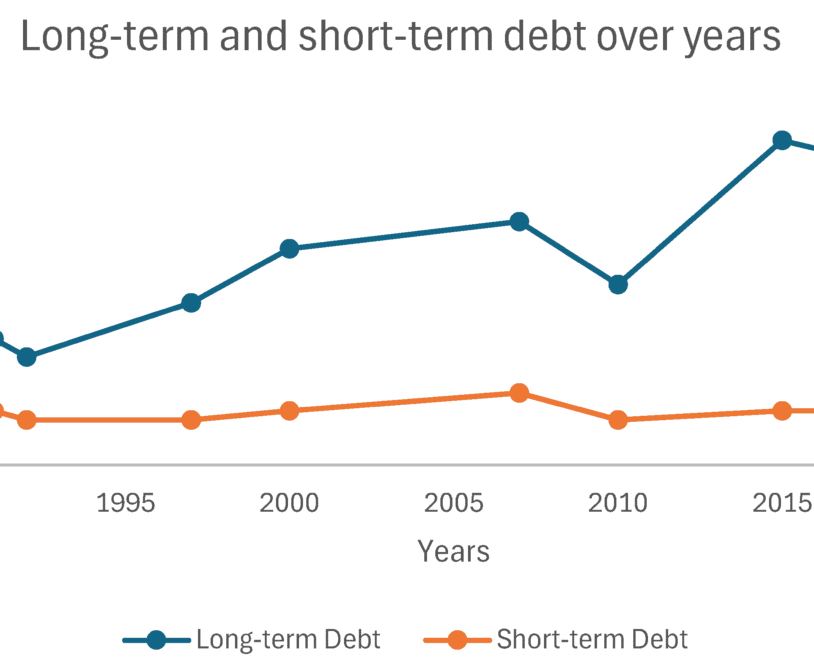

The broiler farming industry in the United States relies heavily on debt financing. This is to keep operations running and to grow. Producers, lenders, and policymakers need to understand how…